SO READ ON is the advice from Jennifer Downing, Partner and Head of the Property Department at CDS Law & Tax LLP.

Where you (as an individual or a company) purchased a site and paid the higher rate of stamp duty (i.e. 6-7.5%) and you commenced construction on the site within 30 months of the purchase then you are entitled to a refund of the difference between the 6-7.5% and the 2% rate.

The key criteria for the refund are:

- You must have stamped the original deed

- You must commence building within 30 months of the date of the deed

- You must develop the required portion of the land for residential purposes.

If you meet the above criteria then you will be successful with your refund claim.

To make a claim, you or the individual who processed the initial stamp duty application can submit the claim through ROS (the Revenue Online System) by uploading:

- A completed Declaration (draft available on Revenue Website)

- A copy of the Deed of Transfer and Stamp Certificate

- A copy of the email confirmation from the local authority acknowledging the commencement notice.

Once filed the refund will be processed and issued to the applicants account as submitted.

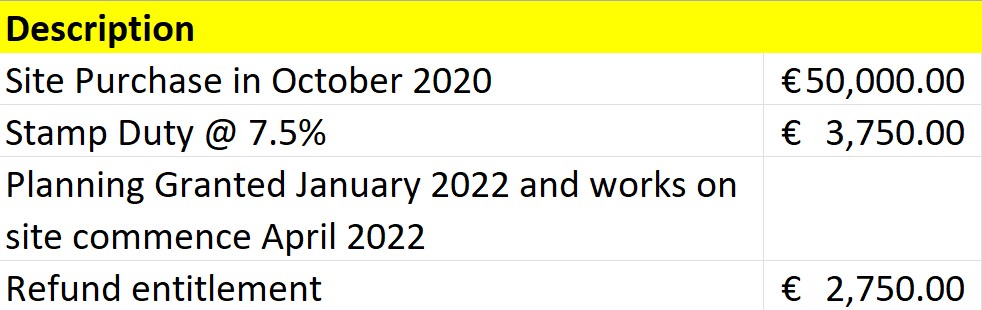

For example:

In circumstances where construction costs are through the roof if you are entitled to a refund, you should get it!

For more information, contact Jennifer Downing, Partner and Head of the Property Department at CDS Law & Tax LLP.

Call into either of our offices located on 4 Denny Street, Tralee or Penrose Wharf, Alfred Street, Cork or phone us on 066 7169033/021 2355810.